UK tenants are dying because of mould infestation: Why is no one listening?

As someone who’s been living in London for over eight years now, in six different rented flats—most of them which I shared with a couple of flatmates—it was almost impossible for me not to face a mould infestation at least once.

Though it should be noted that this conversation has been a constant among UK residents—especially those who can’t afford to leave their home just because their landlord isn’t willing to take responsibility for this type of problem—the topic has recently reappeared in the headlines following the tragic passing of two-year-old Awaab Ishak in December 2020, who died of a respiratory condition caused by prolonged exposure to mould in his parents’ one-bedroom flat in Manchester.

Almost two years later, Gareth Swarbrick—Rochdale Boroughwide Housing (RBH) chief executive who was responsible for the flat where Ishak died and had received multiple complaints about fungi from the toddler’s parents—is still refusing to stand down as leader of the housing association.

“The conversation around my position has begun to overshadow the most important part of all of this, which is that a family has lost their child. Having spoken to the board, I can confirm that I will not be resigning,” Swarbrick announced in a recent statement.

Meanwhile on TikTok, young tenants are sharing horrifying videos of their own struggle with mould infestation, looking for advice on what to do as their landlords screen their panicked calls and emails. Heck, the flat I’m currently renting—for which I pay a hefty sum of money, might I add—has mould slowly creeping up my bathroom’s walls.

On my building’s WhatsApp group, it’s almost become a weekly ritual for someone to post a message asking if anyone else is seeing dark spots pop up in random places, from the corner of their windows to their bedroom’s ceiling.

We try to share tips, like buying this one fairly affordable dehumidifier—Pro Breeze is recommended by one of my neighbours, who also uses hers to age cheese—or cleaning the spots with sugar soap, whatever that is. But just like we know for certain that the mould will come back as soon as the temperature drops, we’ve also learned to accept that our landlords don’t give a damn about our health.

@rachelismith If your my landlady and you see this answer your calls xoxox #moldpoisoning

♬ Originalton - St☆rgirl

Why do British homes get mouldy so easily?

It’s a well-known fact that UK homes are often damp and mouldy, due to a number of reasons, including poor insulation or faulty heating and ventilation systems. In almost all cases, dealing with the issue at hand is the responsibility of the landlord.

And yet, more often than not, tenants are left to their own devices, leading many to suffer from the long list of health problems that come with living in a house that is slowly rotting away. It seeps into our walls, our lungs and can cause major structural issues in a property.

In fact, the situation is so bad that when a survey asking homeowners about their damp situation was conducted by Ipsos and commissioned by the Energy Saving Trust in 2014, the findings were truly shocking.

The survey discovered that 35 per cent of people find it hard to keep their house warm because of poor insulation, 44 per cent lived in a draughty home, 38 per cent complained of condensation problems and 29 per cent said they had mould.

And it’s not looking like anyone is interested in fixing this nationwide problem any time soon. Houses built before 1925 in Britain have solid but very expensive external walls that need insulating. Because of the price, many homeowners put it off.

Add the climate change-induced extreme rainfall and the cost of living crisis to that and we’re pretty much facing a whole country of mould-exposed residents.

How mould in your house can affect your health

@everybodybymel Living in mold made gain weight and develop autoimmune #mold #lyme #EBV #toxic #health #healing #guthealth #recovery #SeeHerGreatness #autoimmune #holistichealth #weightgain #beforeandafter

♬ UNDERWATER WONDERSCAPES (MASTER) - Frederic Bernard

Damp or mould problems in a home are associated with increased health problems including allergic rhinitis, asthma, and other respiratory infections. Some groups, including young children and older people, are especially vulnerable.

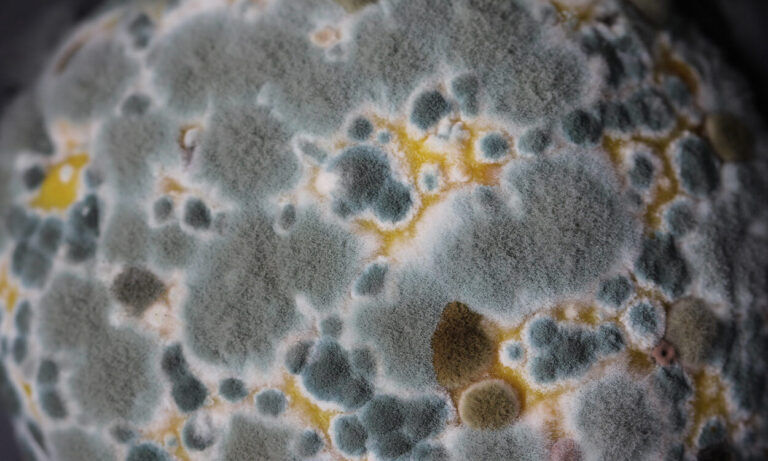

Most moulds spread by shedding microscopic particles known as spores, which can inflame airways and cause wheezing and nasal congestion when inhaled. Prolonged exposure to mould spores—particularly those from the toxic black mould species Stachybotrys Chartarum—can cause severe reactions.

The mycotoxins released by Stachybotrys Chartarum can kill neurons in the brain and affect our psychological condition and mental capacity. It’s not uncommon for people living in properties with major toxic black mould problems to suffer from dizziness, confusion, and even hallucinations if they ingest large amounts of the spores.