The ugly truth behind MLM companies promising financial success in crypto and investing

The words ‘multi-level marketing’ (MLM) immediately rings a bell that, for many, is synonymous with what is known as a ‘pyramid scheme’—and is very rarely seen as a reliable investing opportunity. MLM companies initially gained traction in the 1950s, targeting stay-at-home mums and military wives in rural or suburban areas of the US. Considering these women couldn’t pursue a conventional career for numerous reasons, MLMs stepped in to offer them business ventures from the comfort of their own homes—because, at the end of the day, an MLM corporation doesn’t sell you a product, it sells you a dream.

What initially sounded like an opportunity impossible to miss out on, has slowly led to many women realising the not-so-glamorous reality behind direct selling. What’s meant to be a small initial investment leading to wealth ultimately ends up being a loss and a burden. This year, streaming giant Amazon Prime released a tell-all documentary exposé on LuLaRoe, an extremely popular US-based MLM. The documentary confirmed what many already knew: that it’s nothing but an elaborate pyramid scheme based on lies, fraud and girlboss politics, leading women all over the US who thought they were going to become wealthy businesswomen to file for bankruptcy over some leggings.

But despite the overwhelming amount of information surrounding the dangers of MLMs, they are still far from being eradicated. Where giants are exposed and purged, smaller, newer and shinier competitors appear. Like many other evils, MLMs don’t disappear—they simply evolve.

And so, a new chapter in MLM’s evergreen history has commenced. What started out as recruiting housewives to market makeup or kitchenware has now transformed to also target social media influencers who end up selling skincare and fitness tricks for the Instagram fanatics. In some places, even electricity has become an MLM one can get involved with. Most recently, MLM companies have moved away from their traditional style to prey on those wanting to become the next Jordan Belfort.

The era when talks of currencies, investing and even foreign trade exchange was only for those on Wall Street is long gone—with words like Bitcoin, cryptocurrency or even FOREX becoming a vital part of gen Z’s vocabulary.

The convenient boom of crypto and investing

Nowadays, investing in the stock market or cryptocurrencies is almost as easy as sending a tweet. You just need to download an app, fill in your details, and you’re good to go. Knowing how to do it successfully, however, is a whole other ordeal. And as it happens, MLMs have conveniently stepped in to take advantage of those who know too little.

While it’s possible to learn the basics of crypto and trading through books, articles and even YouTube videos, many seek the guidance of an expert or broker to show them the ropes. This is where the so-called crypto/FOREX academies step in, offering courses at different levels for those interested. Their websites promise to teach all the insider tips and tricks on how to trade better and dominate the market—something that caught the attention of 22-year-old Shy, from Philadelphia. After spending a few months self-tutoring about trading with free materials online, she felt it was time to learn from an expert to enhance her technique and further discover how the world works.

Over the last few years, hundreds of so-called trading academies have popped up all over the internet. From breaking down the concept of cryptos to giving out tricks on how to trade FOREX, they offer the tools and knowledge guaranteed to bring you financial success. Of course, the promise of these big dreams comes at a price, and like every get-rich-quick scheme, everything is not quite how it seems.

Shy, like many others, came across IM Mastery Academy, the biggest online academy for everything remotely related to trading and investing. A quick Google search of the name is enough to set off alarms, as Google immediately recommends a series of YouTube videos of former members leaving the organisation while suggesting questions like “is IM Mastery Academy a scam?” and “is IM Mastery Academy a pyramid scheme?”

Nevertheless, its website is a carefully designed, professional-appearing platform that inspires confidence. You can easily see all the courses—or ‘academies’ as it calls them—alongside a list of tools and insights available in each of them with a price list. Nothing particularly suspicious, but as with every other MLM scheme, appearance is everything. It’s all about selling the dream, remember? This is what Shy quickly realised during her short time at the academy, “It’s very inspirational, but not for the reason you’re signing up.”

In every MLM, there are two important aspects: the product and the distribution line, and only one of those is bringing in the money. When you join an MLM organisation, you are asked to make an initial investment, normally consisting of buying inventory that you will later sell on. For example, with LuLaRoe, this starting inventory is known as an “onboarding package” that costs around $5,500. The idea is that you’ll be able to sell this inventory at a higher price for profit later.

But where the real money comes in with MLMs is through the recruiting: for every person that you bring in, you get a cut of the money they invest and the profit they make. On top of that, you’ll also receive a cut from those who the people below you recruit, and so forth. This is called building a downline, which in turn simulates a pyramid shape—promising you the potential of making enough passive income even with a few recruits.

Educational tools versus recruitment

In the case of these academies, you’re not buying inventory, rather educational tools that will teach you how to trade well enough to start making a profit. There are videos, online classes, documents and even live trading sessions with mentors. But the company doesn’t benefit from you just learning and going off to trade on your own, which is why they encourage you to recruit others. Its courses start at $174.95 monthly and go up to $274.95 with an even higher enrollment fee. These prices can be a problem, but they come with a simple solution: recruiting others into the academy. By bringing two people into the academy, your monthly fee is discounted, a very attractive offer for those who cannot afford to spend hundreds of dollars.

While recruitment isn’t mandatory, the initiative sure is waved in your face in order to get the most out of the academy. “The Zoom calls are almost brainwashing you,” said Shy, who chose not to recruit people as she was only in it for her own personal education. Which, she quickly realised, wasn’t the goal of the so-called academy. The lessons were little more than what you can find on YouTube, and most of the tools they offer can be found online for free in order to do your own trading. Like any other MLM, once again, they are not selling you tools but a dream.

They organise weekend getaways where members share an Airbnb and spend a few days networking and trading together. An opportunity that, of course, is also only available to those actively recruiting. These are all just incentives to make sure you are actively working on getting more people involved in the company, and eventually making them more money. Seeing the bigger picture, it’s clear that, unlike real academies, these FOREX and crypto MLMs don’t prioritise education, but profits in general.

There are no happy endings

At the end of the day, the story of any MLM company is a tragic one. As they continue to evolve over time and target different demographics, the outcome always stays the same. When women were staying at home looking after the kids, MLMs stepped in to offer them convenient work from home by holding parties with other mothers and selling them beauty or kitchen products. Now, with many people confined to the safety of their homes, in many cases unemployed due to the pandemic, MLMs have re-introduced themselves in the dream of becoming rich from this very space.

According to the Federal Trade Commission (FTC), only 1 per cent of people in MLMs in the US make a profit. When it comes to such academies, it’s hard to calculate the success rate, as technically one could invest a few months into the knowledge and use it on the outside to trade successfully all by themselves. But according to Shy and others who eventually left, it’s highly unlikely—as the academy isn’t oriented towards teaching, just recruiting. The goal of the GoLives and Zoom calls is more about inspiration than education. It isn’t a classroom at all, everything is oriented towards selling a dream of financial independence and power by talking about the state of mind you should have to achieve this, without actually explaining how to do so.

It comes as no surprise, but when you’re in one of these places, it’s hard to see the light and not continue to be swallowed into these ideas of success. By using terms and affirmations like “self-made,” “entrepreneur” and adding people to groups called ‘Forex Billionaires Club’, they make the dream seem achievable and close. Close enough to shut down every possible suspicion.

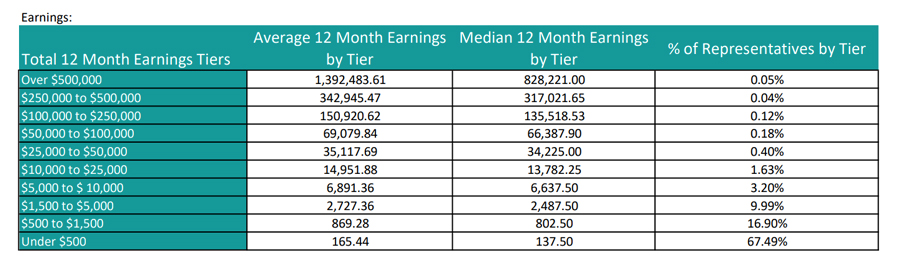

Despite being told that a bit of studying or recruiting will bring in the big money, the truth is just a few clicks away. Even if you want to believe your academy is part of that 1 per cent the FTC warns about, it’s as easy as taking a look at their Income Disclosure Statement and seeing that 67.49 per cent of members made less than $500 throughout 2020, a number that’s lower than the enrolment fee plus the cost of the one-month long courses they offer.

The reality is that MLMs continue to be incredibly dangerous to society, luring vulnerable people in under the guise of financial independence. What they believe to be a great investment in their future ends up being nothing but a gift to an exploiting corporation. As times keep changing and new interests appear on the market, it’s important to remain suspicious of every new business venture that promises great financial success to new demographics.