What type of business person are you? Find out and get the best advice on how to start your own business

Ever lie awake at night wondering what kind of businessperson you are or will become? Do you have big plans—big ideas—but not the necessary financial support needed to get the ball rolling? Does the idea of starting your own business sound dreamy but also panic-inducing? Don’t worry, we’ve all been there. Money talk can be pretty scary, even for ambitious people like yourself, and Asto, the small business finance and bookkeeping tools platform dedicated to helping small businesses and freelancers keep cash flow positive knows it oh-so-well.

“We believe that no business should fail for lack of time, insight, or access to finance,” says Nicolette Maury, Asto’s CEO, and we couldn’t agree more. We know how daunting it is starting a business, which is why we decided to help you. First, we asked six successful business entrepreneurs to share with us their best advice on exactly how to start a small business, so we could guide and inspire you to finally go for it.

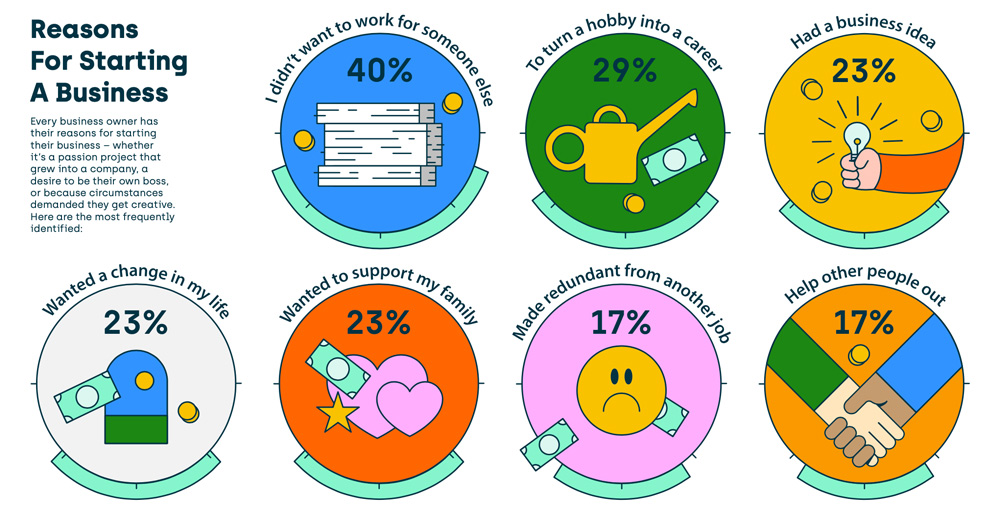

But before you even think of doing that, we realised that in order to start off on the right note, you need to learn what kind of business personality you are—your business is an extension of you, after all. Using a mix of quantitative and qualitative data, Asto identified six core personalities corresponding to the different types of people behind businesses: six Money Mindsets, which were further described in Asto’s report titled The Cash Flow Revolution.

Now, all you need to do is pick the ‘Money Mindset’ that you think fits you best from the six options below, then simply follow the advice specifically tailored to your own persona, and get things going!

Are you ready? Let’s get down to business!

1. Digital Collaborators

Among the 1,000 small business owners and freelancers that Asto surveyed in the UK, 28 per cent of those identified as Digital Collaborators; aspirational entrepreneurs who find talking about money and technology essential to running their businesses.

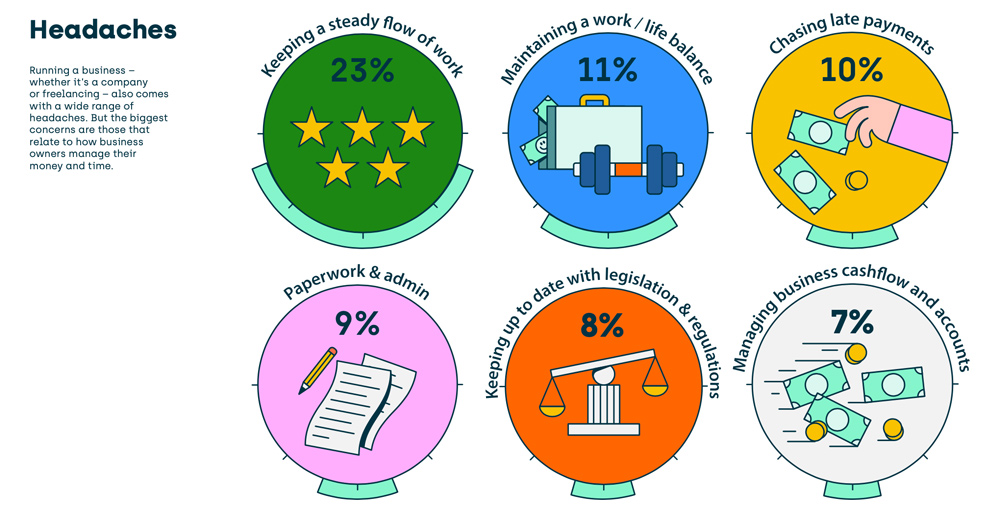

Digital Collaborators are a growing group of entrepreneurs who value talking to other business owners. They’re tech confident (70 per cent of them use a mobile phone to organise their business, and 64 per cent use cash flow or accountancy software to manage their business). You’re definitely a Digital Collaborator if, on top of the characteristics mentioned previously, you find maintaining regular clients or work streams harder than other people do, and if chasing late payments is one of your biggest headaches.

Sound familiar? If it does, and you feel like you’re never shy about sharing the ins and outs of your finances—in fact, if you think talking about money is essential to running a business well, then you’ve already found your Money Mindset. You’re also probably a millennial or even a gen Zer, which means you grew up online and learned not to panic when managing money becomes more challenging than you expected. Instead, you simply know that you’ll find digital tools that can help you manage your finances and solve problems.

Fellow Digital Collaborator Albert Azis-Clauson, CEO and co-founder of Underpinned, has shared is number one tip with us, in order to help those who might identify to the same Money Mindset: “Don’t be afraid of a good old fashioned spreadsheet and ground all your work in numbers. Technology is amazing for managing finances and improving workflows, but when it comes to drawing value out of a conversation about money, nothing beats a spreadsheet. You can’t hide behind the gab and you need to know what the numbers mean.”

Doesn’t sound quite like you? That’s fine—check out the others!

2. Conscious Grafters

Conscious Grafters are the type of business owners that started their business with the ambition to give back to their community. If you’re own of them, you probably don’t see turning a profit as a symbol of good financial health and are more likely than any other Money Mindset to look for solutions online. According to Asto, Conscious Grafters are also the most likely to ignore financial issues with the hope that they’ll go away—and while that can sometimes be seen as a weakness, we definitely feel you on that.

There’s so much to celebrate about being a Conscious Grafter! You’re fuelled by a combination of optimism and hard work, pour yourself into your businesses, and your career probably began as a passion project or side hustle before blooming into a concrete business. While money might come to you as a struggle, you’re a pro at keeping cool and in control.

Feel like you’re definitely a Conscious Grafter? Meet Bejay Mulenga, founder of Supa Network, the business school for lifelong learners. Here’s what advice he shared with us: “Whatever you do, don’t constantly compare yourself to others. If you believe in your project and put in the effort, then you can make it work. But also, make sure you really have a look at your cash flow. If you don’t, you’ll end up missing something and won’t understand why you finish the month with close to nothing.”

3. Enterprising Rationalists

Where do we start with Enterprising Rationalists? No one pivots like these ‘accidental’ entrepreneurs who are defined by the fact that it was circumstance, not choice, that drove them to go freelance or start a business. They are the most adaptable and proactive Money Mindset there is, and never rest on their laurels.

Although they tend to struggle to ask for advice or speak about their business finances, Enterprising Rationalists seek out advice from a broad range of places and are most likely to trust tools that they’ve seen advertised, found online themselves or been recommended from someone they trust.

If you identify as an Enterprising Rationalist, you enjoy a good challenge, don’t deny it! Be careful not to take on too much and remember that sometimes, asking for help is the best way to deal with things. Look after your mental health too, because we’ve only got one.

Benji Reeves, co-founder of both Cortex Creatives, a creative agency and community for the next generation, and Clear Water, a mentoring platform for creatives, shares his personal advice as an Enterprising Rationalist: “Be fearless, stay persistent, be flexible and adaptable. Embrace change and learn from any errors you make. Grasp and execute opportunities. Be resilient and numb to the naysayers.”

4. Canny Pragmatists

Canny Pragmatists are the business owners that feel ‘in control’ of their business finances—money stress is not something they’re familiar with, they’re too organised for that. If you’re one of them, chances are you started your own business using personal savings, which is amazing! Canny Pragmatists define good financial health as being in control of their business finances, and many thank the tools they use for that sense of security.

Only once you’re sure you can’t solve a problem yourself (and you probably can most of the time) will you ask for someone’s help. But being ready for everything comes with a price; Canny Pragmatists are often reluctant to embrace modern financial products and services that could help leverage their existing skills to grow and develop their business further. Just admit it, you like things just the way they are and change slightly scares you.

You could benefit from easy-to-use accountancy and expense-tracking software as well as short-form financial news, which would make your life easier by giving you digital tools and new business financing options. Screen Shot spoke to Canny Pragmatist Georgiana Huddart, co-founder and creative director of Hunza G, the go-to sustainable bikini brand for all the most influential women of Instagram, who advised fellow Canny Pragmatist entrepreneurs, “Don’t spend too much money before you know exactly what you are as a company… in the initial stages things change so much and it’s good to keep to quite a tight budget while you are growing organically.”

5. Headstrong Traditionalists

Here come the Headstrong Traditionalists, but don’t worry, they sound worse than what they actually are. First of all, they’re the largest group of entrepreneurs Asto ran into and make up the 40 per cent of the ones who wanted to be their own boss—you guessed it, freelancers! As you might have predicted from their name, Headstrong Traditionalists are also the most likely to use paper records and files to run their business instead of digital tools.

for two reasons: to provide financially for yourself and potentially your family, and because being your own boss is one of your main goals. But this doesn’t mean that getting rich isn’t in your plans; you are decidedly money-focused and on your way to get that paper. You tend to see challenges as an essential part of your entrepreneurial journey and although you always take your time when it comes to overcoming them, you could use a bit more help from others. You just need to swallow your pride and reach out!

Dear Headstrong Traditionalists, we love to see you do your thing, but don’t underestimate the power of collaboration. We asked freelance writer and journalist, and creator of The Aram newsletter Tahmina Begum to share her best tip with other Headstrong Traditionalists and she advised: “Make sure your days are not swamped by admin by outsourcing the things you can. For example, I use online tools for my invoices and bookkeeping. Also, don’t be scared to ask for higher fees and find out what other people are making.”

6. Bold Risk Takers

Last but not least, here come the Bold Risk Takers, the ones in it to make big money (but also the ones most likely to ricochet between feeling optimistic and stressed). If you’re a Bold Risk Taker yourself, then you’re probably plagued by big highs and lows when it comes to your finances—however, for you, it’s all worth it in the long run.

Even though you can often struggle with feelings of isolation and stress when times are tough, you don’t mind mixing business with pleasure—on the contrary, you are the least likely to worry about your work/life balance. Hats off to you! While you may feel a need for speed in everything, it’s important that you take the time to research products and tools before adopting them, as your fast-growth approach to business will test tools to their limits.

Finally, remember to take care of your lovely self in order to avoid burnout and embrace proactive approaches to stress management on what you know might be a bumpy ride. Bold Risk Taker Chika Russell, CEO and founder of award-winning African-inspired snack products Chika’s Food, explains that “Sure, there are varying sizes of risks, but by virtue of being an entrepreneur, one already has a certain tolerance for risk.”

Her advice for other Bold Risk Takers? “First, be intelligent with your risks—you need to build some confidence into each risk, and that can only be done through detailed analysis. Secondly, always plan a premortem, this means identifying possible outcomes should your risk fail and planning for them. Thirdly, just get on with it. There is only so much analysing and mitigating you can do. The best teacher is failure.”

You heard the professionals, now the ball is in your court.